- What is Easy Payment Scheme?

Easy Payment Scheme is the new feature whereby allowing customers to convert online

transaction to an instalment with the Credit Card Company or financial institution.

- Which bank’s card holder can participate?

The card holder can participate in the easy payment scheme if they are using credit card

(Visa and MasterCard) issued by one of the following Credit Card Companies or financial

institutions:

1. AEON Credit

2. Affin Bank

3. Bank Simpanan Nasional

4. Citibank

5. Hong Leong Bank

6. HSBC Bank

7. Maybank

8. MBF Card

9. Public Bank

10. RHB Bank

11. Standard Chartered Bank

12. United Overseas Bank

Note: The above list is subject to changes from time to time in accordance respective bank

policy without prior notice.

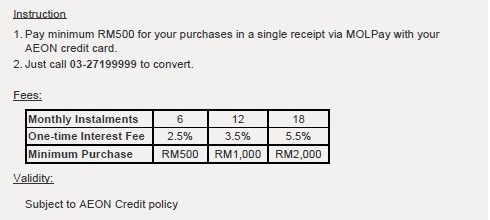

- What are the minimum requirements for card holder to participate?

The card holder must transact minimum of Malaysian Ringgit (MYR) 500.00 via participating

banks’ credit card (Visa and Mastercard only) in a single receipt. The minimum transaction

amount eligible for easy payment scheme also subjects to the tenure of instalment taken by

the card holder.

- Is it 0% interest for the card holder?

Yes, there is a 0% interest instalment payment plan, subject to the tenure of instalment taken

and it also varying from bank to bank.

- How much interest charged to card holder under this easy payment scheme?

The interest charged is ranging from 2% to 10%, subject to the tenure of instalment taken

and it also varying from bank to bank.

AEON Credit

Affin Bank

Bank Simpanan Nasional

Citibank

Hong Leong Bank

HSBC Bank

Maybank

MBF Card

Public Bank

RHB Bank

Standard Chartered Bank

United Overseas Bank

- What are tenures offered under easy payment scheme?

The standard tenures offered by banks are 6 months, 12 months or any tenure defined by

bank and it varies from bank to bank.

- How easy payment scheme works?

Step 1: Buyers make payment by credit card online.

Step 2: The credit card payment will be processed online usual.

Step 3: Once the card payment is authorized successfully, buyers will be informed the

payment status is successful.

Step 4: The buyer will be notified by MOLPay system the steps of converting a transaction to an

instalment for buyer’s bank including interest charged and tenure offered, either via pop up

window or email.

Step 5: Buyers just follow the instruction as stated in the popup window or email to convert their

transaction into instalment.

Step 6: If bank approved buyers’ request, buyers just pay back to their back on instalment basis as

they applied with the bank.

Note: Step 4 only is activated when buyer is found to make Malaysian Ringgit (MYR) 500.00 and above

via credit card (of participating bank) successfully.

AUD

AUD  BND

BND  CNY

CNY  EUR

EUR  HKD

HKD  IDR

IDR  INR

INR  JPY

JPY  KRW

KRW  MYR

MYR  PHP

PHP  SGD

SGD  THB

THB  TWD

TWD  USD

USD  VND

VND